In This Article:

- What Exactly is a Family Office?

- The History of the Family Office

- Types of Family Offices

- Is a Family Office Similar to Private Banking?

- Do I Need a Family Office?

- Should You Build or Outsource Your Family Office?

- The Benefits of Having a Family Office

- How Multi-Family Offices Invest

- Considering a Family Office?

Most familial wealth is short-lived—can your family buck the trend?

According to NASDAQ, “70% of wealthy families will lose their wealth by the second generation; 90% will lose it by the third.” The Family Firm Institute agreed with this conclusion, stating that only 30% of wealth filters into the second generation. By the fourth generation, 97% of that wealth is gone.

Can a family office offset or prevent wealth erosion?

A family office can be utilized to preserve and grow wealth in the present and for future generations. Additionally, if managed well, a family office can provide future generations with the infrastructure for successful wealth management.

What Exactly is a Family Office?

A family office is an entity established to manage private wealth and family affairs. Just as importantly, a family office is designed to help ensure the transfer of wealth from one generation to another.

While that definition may sound a lot like investment management, there are important differences between the two.

- Investment management firms manage money for a broad client base. These firms focus on individuals, businesses, and institutions; they have to balance the needs of the many with a client’s individual goals.

- Investment and traditional wealth management services are narrow and offer less customization. Investment management, financial, and retirement planning are generally standardized. These services alone, while necessary, may not be enough for individuals of significant wealth.

On the other hand, the family office focuses on the goals of the few.

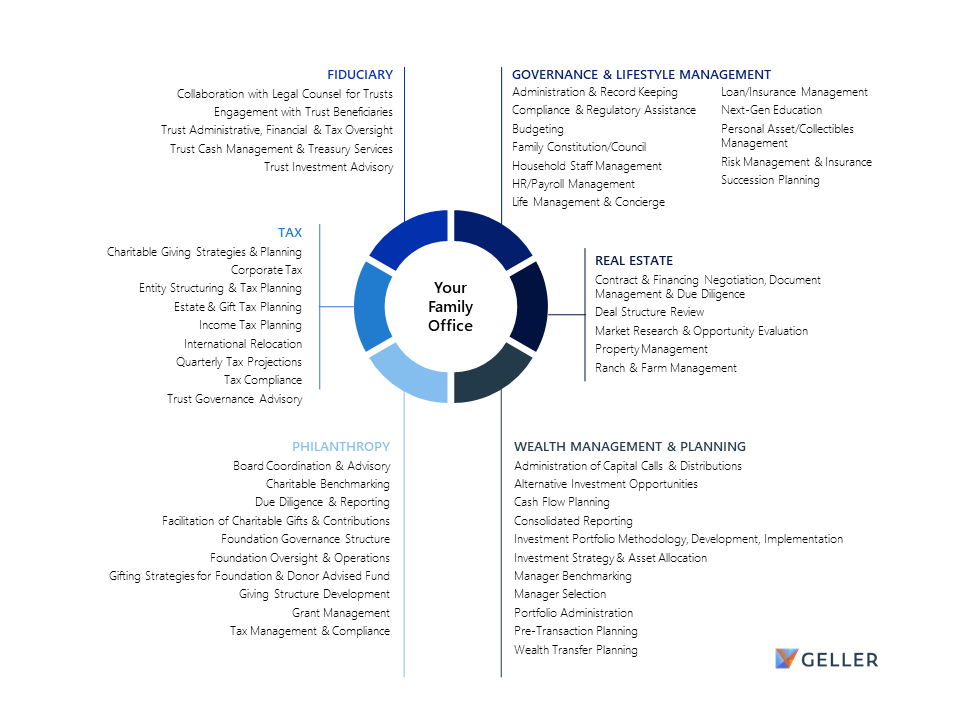

A family office is a private, comprehensive wealth management advisory firm for high-net-worth individuals. This structure focuses on one or multiple families. The offerings of a family office are private, complete, thorough, and customizable. They provide families with tailor-made options that include integrated tax planning, charity and philanthropy, family governance, and, of course, wealth planning and preservation strategies. A true family office manages every aspect of an individual or family’s wealth—and offers expertise through internal experts.

Over the years, the rise in popularity of this concept has led to an overuse of the term “family office” in the marketplace. Naturally, given its appeal to high-net-worth and ultra-high-net-worth individuals—and the status obtained from that appeal—financial management firms that rely on outsourced providers to complete their scope of services are calling their businesses, or verticals within their business, a “family office.” Buyers beware: term-saturation has resulted in term-dilution for family offices. A predominantly outsourced structure could also be counterintuitive to the work that a true family office considers imperative to proper wealth planning.

The History of the Family Office

J.P. Morgan founded his “House of Morgan” in 1838, followed by J.D. Rockefeller in 1882. Other notable families would follow suit, including the Carnegies and Vanderbilts. The family office continued to grow in prominence as the World War II boom, private banking, and the dot-com era produced a significant amount of wealth for business owners. As of mid-year 2023, researchers estimate that there are more than 7,000 to 11,000 family offices across the globe.

The family office structure has matured over the years; there are several types of family offices, each with their own focus areas.

Types of Family Offices

The family office can be broken down into three sub-categories.

- The single family office: As the name suggests, this type of family office manages the wealth, affairs, and tax optimization requirements for a single family. This structure is usually created by the founding family and offers a high degree of customization. Typically, the family has a complex multi-generational structure and focuses on several long-term goals: (a.) maintaining and compounding familial wealth, (b.) providing a blueprint and investment direction for the family as a whole and, (c.) successfully transferring wealth from one generation to another while providing privacy.

This is ideal for: The commonly-referenced rule-of-thumb is $300 Million of total managed assets, but our experience has demonstrated that $500 Million may be the new minimum threshold. - The multi-family office: This family office services more than one family and comes in two varieties: (a.) a multi-family office entity that serves the needs of several families, (b.) a family-owned multi-family office that serves the needs of a select few founding families.

What makes the multi-family office different? (a.) An abundance of talent—a multi-family office offers access to a large pool of talented professionals, (b.) a wide variety of investment opportunities and, (c.) service options that help to deliver economies of scale (that have the potential to enable lower prices for services). True, outsourcing provides the family with less control versus the single-family office, but the talent pool and greater investment opportunities can produce significant growth.

This is ideal for: Families who have a diverse set of goals and are comfortable utilizing a suite of trusted advisors. By nature, this format is also far simpler to manage and requires less oversight. - The virtual family office: This is very much a niche option that’s growing in popularity due to advancements in technology. The virtual family office is a collaboration of multiple service providers, such as an investment manager, legal advisors, tax advisors, and personal CFO services, who are typically organized through one lead advisor. Think of this as a multi-family office that chooses to outsource its services rather than provide a full set of amenities “in house.” These independent professionals are active in their own firms, but they coordinate with each other, working together on their client’s behalf.

This is ideal for: Families who believe that their needs are clearly defined and straightforward, where consolidation would create more complexity than necessary (or where a single primary advisor who acts as an “advisor of advisors” is more than sufficient).

Is a Family Office Similar to Private Banking?

The family office is like an orchestra conductor, and banks are musicians playing a single instrument or range of instruments. There’s a certain amount of similarity and overlap between family offices and private banks; however, there are also some important distinctions.

Family offices:

- Handle all aspects of wealth management and financial administration with a multidisciplinary approach, spanning investment management, tax services, and personal concierge/CFO services.

- Provide services based on the needs of the family; a family office is paid to share advice, convey knowledge, and confer expertise.

- Have both a 10,000-foot and highly-detailed view of a family’s wealth and financial circumstances. As a result, they can offer precise, long-term, strategic advice.

- Banks typically see only a small subset of a family’s wealth and as such aren’t always able to provide strategic advice in the same way. On the other hand, a family office is uniquely positioned to address a wide set of challenges.

It all comes down to complexity. Complexity in this context refers to a variety of details, including:

- The number of family members

- The number of generations served

- Geographical location

- Familial demands

- The nature or complexity of businesses and assets held

- Legacy issues

The question persists: Do you actually need a family office?

Do I Need a Family Office?

Take some time to think about these questions (and their implications).

- Can your base of wealth support the necessary team of investment and accounting professionals you’ll need (i.e., salaries, infrastructure, technology, etc.)?

- Do your children/grandchildren have the long-term plan or blueprint to manage your family’s wealth successfully?

- Is the next generation of wealth well-equipped to manage significant wealth?

- Are you confident in your wealth transfer strategy and estate plan?

- Do you have the time and expertise needed to manage and expand your family’s holdings or financial affairs?

- Do you foresee a liquidity event in the near future? Do you have a structured plan in place for these events?

These questions are an important starting point to identify whether a family office could help you meet your financial objectives. Understanding the specifics of your situation and your goals also means you’ll gain clarity on the type of family office that best suits your needs.

You’ll also need clarification related to whether it’s best to build a single family office or outsource your family office to a multi-family office.

Should You Build or Outsource Your Family Office?

This is an important question to consider in its own right. Both options have advantages and disadvantages.

Advantages of building a single family office:

- The founding family receives more privacy, control, and oversight

- The technology stack and services can be tailored to family’s exact requirements

- Typically, no requirements to register with the SEC

- Can keep core services in-house while outsourcing others

- Greater privacy means investment knowledge stays in the family

- Staff can wear multiple hats and serve on an ad-hoc basis

Disadvantages of building a single family office:

- Setup and maintenance costs are high

- Finding, acquiring, and maintaining qualified personnel can be a challenge

- The greatest level of responsibility—and regulatory burden (at the state and local level)

- Must exclusively serve family clients to avoid SEC registration or requirements

Advantages of outsourcing your family office to a multi-family or virtual family office:

- Lower costs and overhead

- Helps to deliver economies of scale, reducing service pricing

- Access to a large pool of qualified personnel and professionals

- Add or remove services as your strategy dictates

- Immediate access to most up-to-date technology and security

- Reduces key-person risk

Disadvantages of outsourcing your family office:

- Less privacy, control, and oversight

- Advisor Act registration and reporting forms are publicly available

- Must coordinate personnel and services to maintain performance

- Matching systems to what you already have in place is challenging and often comes with transitional pain

- Performing due diligence or monitoring providers takes ongoing time and effort

Choosing between building a single family office versus outsourcing to a multi-family office requires careful evaluation of your circumstances. The more clarity and insight you have into your circumstances, the easier your decision may be.

But why go through the trouble?

What makes a family office beneficial? Wouldn’t it be easier to take an ad-hoc approach, adding professionals and support when needed? This is a common trap that many families fall into—and when you don’t have a plan, any path leads you to your destination.

The Benefits of Having a Family Office

While legacy preservation is the primary advantage, there are a variety of benefits that can come with the family office.

- Performance Synergy: Working with a collaborative team of professionals who know each other well produces results greater than the sum of their individual efforts. A team that works well together will consistently outperform the ad-hoc group that second-guesses individual team members. This is important because it can produce…

- Greater returns in a shorter period: The shared pool of intellectual capital and intangible assets (i.e., unique methodologies) means your family office can achieve greater returns faster due to (a.) a deep understanding of the family’s goals and objectives, (b.) clarity on the investments that best align with your family’s investment criteria and core family values, (c.) clarity on your family’s timeframe/time horizon (i.e., liquidity events in the future).

- A higher probability of success: The right team means excellent investment governance. Clarity on your vision, family values, goals, and risk tolerance creates a virtuous cycle. This unites the family and the investment team, ensuring everyone sings from the same song sheet.

- Lower costs over time: At a certain point, it’s more cost-effective to bring your financial management under a single provider whether that’s a single family or multi-family office. If your assets have reached the stage where you can support a family office, you’ll find that it’s an effective option. Managing a large pool of assets under one provider comes with a significant potential to lower fees and, in the case of multi-family offices, can provide greater access to investment opportunities. All of this leads to…

- Multi-generational legacy preservation: The right team, a shared pool of intellectual capital, excellent investment governance, and goal clarity means your family is likely to achieve consistent and repeatable results over the long-term, across generations. So long as your family follows the plan (and routinely updates that plan with the help of your family office’s advisors) and selects the right team, you’ll have what you need to help preserve and expand your family’s wealth.

These are the overall benefits of a family office. Assuming that a family has completed their due diligence and they’ve decided that a family office is right for them—how does the family office invest?

How Multi-Family Offices Invest

Family offices begin with enthusiasm and the best of intentions—namely protecting and expanding the family’s wealth for future generations. However, diverging interests, shifting values, complicated tax structures, and evolving cultural norms can make the task of maintaining and protecting wealth a challenge.

As we’ve seen above, outsourcing a family office can provide access to a large pool of qualified personnel, greater customization, and the ability to quickly adjust as your strategy dictates. But this doesn’t solve the issue of diverging interests; how can a multi-family office address these issues?

While investment strategies differ from firm to firm, at Geller, we develop a customized wealth plan and an Investment Policy Statement that reflects the long-term goals of our clients and sets parameters. These parameters include:

- Cash flow needs

- Return expectations

- Risk parameters

- Defining appropriate benchmarks

- Socially responsible/sustainable investing

- Oversight structure

- Review and monitoring procedures

Properly formulated, the Investment Policy Statement means everyone is on the same page.

In the past, investment performance was the primary driver in determining how family offices spent their money. Today, individuals and clients look at both performance and social responsibility, contrasting this with their purpose or mission to determine the mark they will leave on the world.

The focus is no longer on just wealth preservation. It’s about shared purpose and orienting the family legacy around values that matter. A frank discussion with your firm is a great place to start.

We recommend individuals and families ask potential firms the following questions:

- How does the firm customize their investing strategy to the client’s intent?

- How does the firm select money managers, and do they manage money in-house?

- What is the firm’s process for sourcing new investments and investment opportunities?

- What services are provided in-house, by the firm’s investment team?

- What are the firm’s capabilities for non-traditional assets?

- Does the firm offer access to proprietary investment vehicles?

- How does your firm monitor that asset class allocations are in line with a client’s investment policy?

- What happens when a client’s portfolio is not in line with the investment policy?

- What is the universe of money managers that you will select from? Will you be managing money in-house?

- What are your firm’s capabilities on non-traditional (alternative) assets (performance analysis and benchmarking)?

- What’s the firm’s succession plan for leadership and key employees?

- Does the firm offer investment clients other services at a discount?

Look for firms with an advisory approach that is careful and thoughtful. The planning process should be collaborative as it’s critical to investment success; search for a portfolio composition that’s tailored to your family’s specific risk profiles, investment strategy, and liquidity requirements. A word to the wise: Simply chasing the best possible investment returns may not always lead to the most desirable outcome—managers may occasionally outperform their peers for short-to-medium timeframes, but they eventually revert to the mean.

Considering a Family Office?

As we’ve seen, wealth erosion isn’t the exception… it’s the rule.

Successful wealth transfer strategies require a significant amount of time and expertise. As a family’s holdings grow, managing financial affairs can become increasingly complex. Establishing a family office is an intelligent way to ensure a family’s wealth and legacy will be sustained across generations.

However, families now have the ability to tailor—by creating or outsourcing —a family office that meets their needs. One of the most important steps a family can take is to perform initial due diligence in order to ensure that the structure they select will meet their expectations.

Geller’s wealth strategy professionals are available to talk through your family’s specific objectives and questions prior to making this important decision. Contact us to schedule an introductory discussion and learn more.