It’s easy to get complacent in a bull market such as this. Since November 2023, the S&P 500 has returned +27%.[1] This recent bull market, fueled by falling CPI prints, strong earnings, the AI boom, and the Federal Reserve’s stoppage of rate hikes, has propelled investors back into equities. It can sometimes seem like the good times will go on forever.

Over the past decade, the S&P 500 has benefited from long-term low interest rates and a relatively calm geopolitical environment, resulting in a +223% return, equating to a +12.54% annualized return.[2] While this performance is impressive, it is crucial to recognize that extended periods of growth can be followed by downturns, especially in high interest rate environments. Historical trends suggest that market cycles are inevitable, underscoring the importance of strategic diversification to weather any economic conditions.

Historical Perspectives on Market Stagnation

U.S. equities have shown robust long-term growth, but this overarching trend masks several extended periods of flat or negative performance influenced by broader macroeconomic conditions:

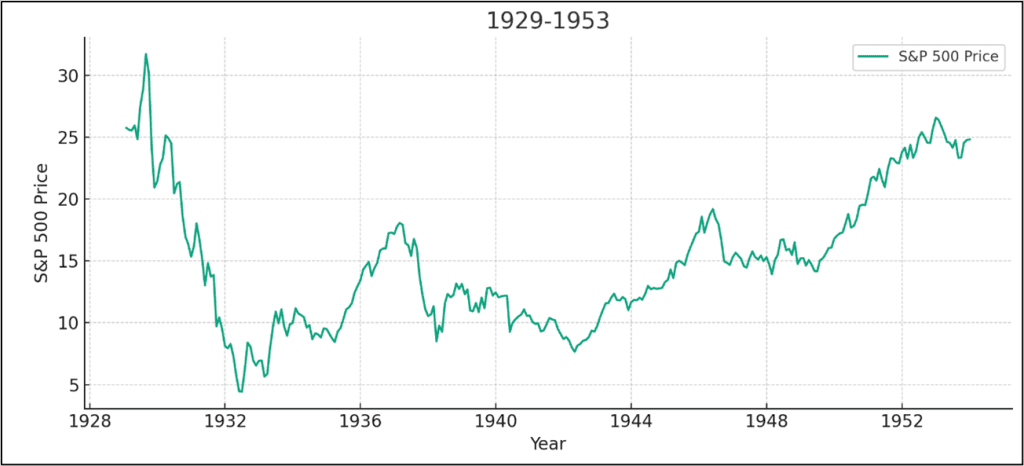

1929 – 1953: The Great Depression and World War II

The catastrophic market crash of 1929 at the end of the Roaring 20s led to the Great Depression, with recovery hindered by high unemployment, the Smoot-Hawley Act, deflationary pressures, and widespread economic uncertainty. The onset of World War II in the late 1930s eventually catalyzed industrial growth and war-related production, but it wasn’t until the post-war economic expansion that the markets truly began a sustained recovery.

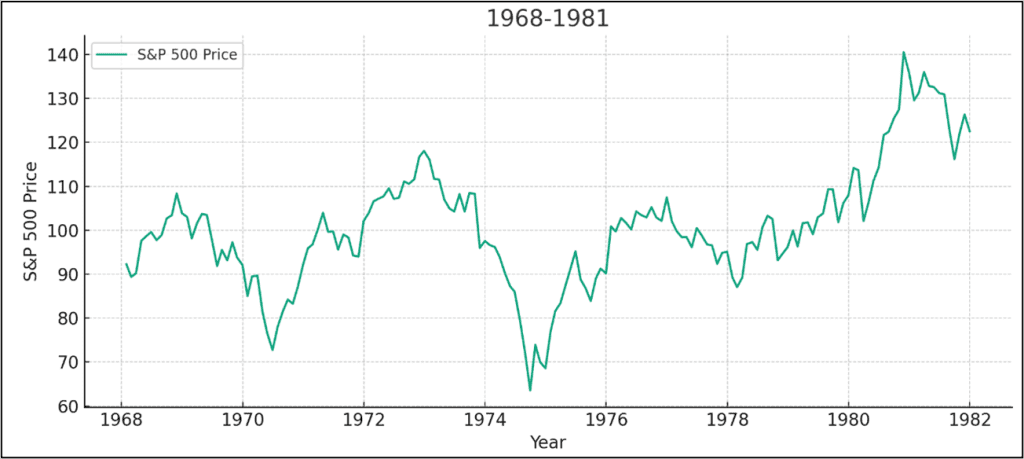

1968 – 1981: Stagflation and High Interest Rates

Coming after the technological progress (Space Race) and high growth of the 1960s, this period saw a perplexing combination of high inflation and stagnant economic growth, triggered by energy crises and regulatory policies. The Federal Reserve’s efforts to combat inflation through high interest rates stifled investments in equities, leading to a prolonged market stagnation, especially when measured in “real” terms (inflation-adjusted).

2000 – 2011: The Dotcom Bubble and the Great Recession

The early 2000s witnessed the bursting of the dotcom bubble, which was followed by a slow recovery process exacerbated by the 2008 global financial crisis. This crisis, triggered by the collapse of housing markets and associated financial products, led to a severe worldwide economic downturn, the effects of which were felt well into the early 2010s.

We believe that these historical episodes highlight the vulnerability of equity markets to broader economic forces and underline the necessity for strategic diversification.

Enhancing Portfolio Diversification Beyond the S&P 500

Historical fluctuations and periods of stagnation within the S&P 500 make it evident that diversification beyond the S&P 500 is not just a precaution, but, in our opinion, a necessity for portfolios. We believe this allows investors to capitalize on different economic cycles by mitigating risks associated with prolonged downturns or stagnant markets.

The Case for Alternative Investments

As traditional markets face the inevitability of cyclicality, alternative investments present opportunities to both harness growth in buoyant times and provide downside protection during economic hardships. With that inevitability, and with our current bull market starting to show its age, we recommend incorporating alternative investments into a diversified portfolio. We believe the four alternatives below can provide an uncorrelated return stream relative to broad equity markets and still participate in equity market growth. Adding these asset classes to your portfolio is a way to navigate the complex dynamics of the economic and geopolitical landscape today:

1) Private Equity Secondaries

Private equity (PE) secondaries involve the buying and selling of pre-existing investor commitments to PE and other alternative investment funds. Unlike primary PE investments, which are made directly into PE funds by investors, secondaries provide a mechanism for investors to liquidate and transfer their stakes in the fund to other parties. The secondaries market has grown significantly as investors seek liquidity options for their long-term, illiquid private equity investments. Since 2014, the annual capital raised targeting the secondary market has increased 304%.[6]

Secondaries also offer buyers a way to access PE funds potentially at a discount or with a shorter remaining investment period. Because of the lack of M&A and IPOs in the current market, traditional PE investors have not been receiving significant distributions. Additionally, during the sharp downturn of public markets in 2022, endowments, pensions and foundations found themselves out of sync with their asset allocation targets. That resulted in flood of limited partner (LP) interests into the secondaries market. Those sales have come to market at substantial discounts to net asset value (NAV), offering investors who are seeking to diversify out of public markets an attractive entry point to this growing alternative investment category.

2) Diversified Venture Capital

Diversified venture capital refers to an investment strategy that spreads capital across a wide range of startups and growth-stage companies in various sectors and stages of development. This approach aims to mitigate the inherently high risk of investing in early-stage companies by capturing the potential high returns from successful ventures, while also spreading the risk across different industries, technologies, and business models. Top quartile venture capital funds have returned an annualized +20.1% over the last 10-years, while bottom quartile venture capital funds have annualized at -3.8%.[7] Therefore, if you are investing in venture capital it is highly important to be invested with the correct managers and to be diversified.

For investors looking beyond the S&P 500 index, diversified venture capital presents an attractive investment strategy that can adapt to changing economic dynamics and capitalize on emergent technologies and business models. The prolonged period of low rates between 2011 and 2021 that saw staggering returns on investments, such as Facebook, Airbnb, Uber, SpaceX, and numerous others, ultimately created a “risk bubble,” as noted by venture capitalist Bill Gurley [8]. In retrospect, we believe during this period, new entrants to the venture market provided the asset class with too much capital which stretched valuations. In our opinion, too many dollars were chasing after too few great ideas, which resulted in extended valuations and placed emphasis on growth over profitability. However, we believe that the backdrop for venture capital is more attractive now than it was in 2021/2022, and a thoughtfully allocated portfolio has the potential to achieve strong performance.

3) Structured Revenue Share Agreements

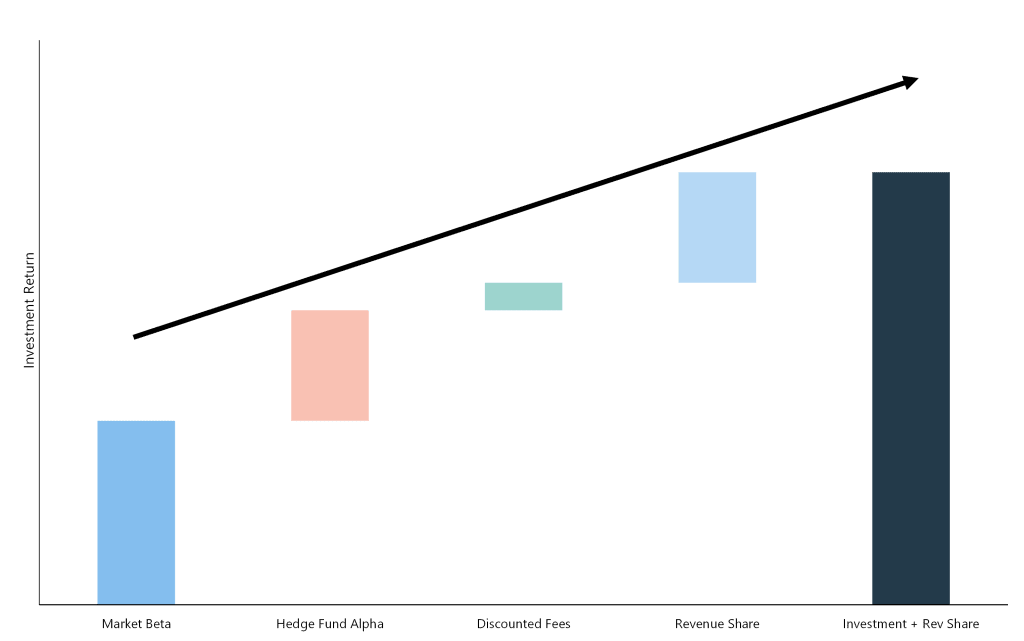

Structured revenue share agreements with hedge funds are innovative investments that allow investors to earn returns that are directly linked to the revenue and profits generated by the fund’s trading strategies. These agreements typically provide hedge funds with large investments in the fund’s flagship strategy, and participation in the hedge funds revenue, offering potential share in the fund and the firm’s success. This arrangement helps to align the interests of the hedge fund managers with the investors, as it not only incentivizes fund managers to perform, but it also offers investors a transparent and direct stake in the operational success of the fund. As outlined in the exhibit below, the investor benefits from potential hedge fund alpha, discounted management fees, and revenue share.

Potential Benefits of a Revenue Share Investment[9]

In short, we believe structured revenue share agreements create a compelling risk-reward opportunity and offer an uncorrelated return stream, further diversifying investors from public market exposure.

4) Diversified Portfolio of Hedge Funds

Investing in a diversified portfolio of hedge funds helps to mitigate risk while tapping into the potential for uncorrelated return streams, representing yet another way to reduce exposure to the volatility of the public markets. For the last 20-years the HFRI Fund-of-Funds Index has a 73% correlation to broad U.S. equity markets and an 11% correlation to the U.S. investment grade bond market.[10] By pooling investments across a variety of strategies (e.g., long/short equity, global macro, event-driven, etc.), we believe, these funds can smooth out volatility and provide an uncorrelated return stream. This not only enhances risk management, but it also capitalizes on the expertise of seasoned managers, making it a valuable option for investors looking to diversify their portfolios through alternatives and achieve sustained growth.

Conclusion

Geller Advisors feels that investing beyond the S&P 500, using strategic alternative approaches, can provide investors with a toolkit for managing potential downturns and capitalizing on diverse economic opportunities. By integrating these alternatives into a broader investment strategy, it may be possible to achieve a more stable investment portfolio that adapts to both market conditions and investor objectives.

For tailored investment advice or to explore how these strategies might fit into your investment portfolio, please contact Jonathan Barbato and Nicholas Hall-Risko.

[1] Sourced from Bloomberg and as of May 31, 2024.

[2] Sourced from Bloomberg and as of May 31, 2024. Trailing 10-Year Performance.

[3] Source: Bloomberg.

[4] Ibid.

[5] Ibid.

[6] https://www.secondariesinvestor.com/secondaries-fundraising-more-than-doubles-to-hit-all-time-high/

[7] J.P. Morgan Guide to Alternatives. February 29, 2024.

[8] https://abovethecrowd.com/2015/02/25/investors-beware/

[9] This information is for illustrative purposes only and past performance is not indicative of future results. Future returns are not guaranteed and loss of principal may occur. Geller Advisors makes no guarantees or representations regarding increased return potentials.

[10] The U.S. equity market is proxied by the S&P 500 Index and the U.S. investment grade bond market is proxied by the Bloomberg Aggregate Bond Index.