Bringing children into the financial fold is, or should be, a natural part of raising children—but that doesn’t mean that it’s always intuitive.

While there are a number of ways to approach financial education for your children, we recommend having open, honest, and matter-of-fact conversations introducing money as something to be thoughtfully managed and as a tool that helps people live their lives.

Foregoing these conversations leaves the door open for outside influence. Children will unavoidably gain their own perspective, whether that’s through friends, or the influence of social media or pop culture.

As true with the development of any skill, consistency, self-regulation, and positive reinforcement are at the core of financial education. Staying true to guidelines you’ve set in the near-term will allow both you and your children to reap the benefits of solid wealth education sooner rather than later. Delayed gratification, natural consequences as a result of decisions or actions, and even frustration or disappointment are part of the learning process that builds solid and healthy habits.

Below, we offer some of our favorite tips, resources, and tools to engage kids at a variety of ages. Additionally, our wealth advisors are always available to have further discussions with your family as you desire and deem appropriate. As always, do not hesitate to reach out to us with any further questions.

Raising Stewards of Family Wealth

When it comes to introducing the rising generation to financial concepts and wealth education, a tailored, holistic approach can help to activate generations to come—and your wealth advisors can play a vital part. In fact, even when families first come together, wealth advisors can start by supporting conversations and helping to define objectives that can shape a family’s ethos and approach to wealth and the management thereof. Here’s what Director, Senior Client Relationship Manager, Meghan Grainer has to say about the issue:

Establishing peer-to-peer connections with future wealth inheritors at a young age can help to normalize conversations that will guide these future generations to become stewards of family wealth.

- Forming a Relationship: Connecting your children with your wealth advisor establishes an important relationship. Doing so can assist them in establishing (or understanding how to establish) a network of resources, peer groups, and financial mentors who serve as support to answer questions and provide guidance when it comes to financial matters.

- Establishing a Consistent Dialogue: Regular and ad-hoc conversations between members of the rising generation and your wealth advisor can foster helpful dialogue to discuss current events or financial topics on children’s minds—no matter what those questions are. Meeting the rising generation where they are in financial conversations is essential to keep the conversation going.

- Providing Education: In addition to self-education as outlined above, more formal education sessions (provided by your wealth advisor) that cover basic financial concepts with visual aids and media recommendations are another way to engage the rising generation, as endorsed by the parent or guardian.

- Supporting Active Learning: Finally, allowing the rising generation to play an active part in making some financial decisions (be that in charitable vehicles or investing their own money) brings abstract concepts to life—and can allow children to see the impact of their decisions in real-time, over time.

Young Children | 3-8 Year’s Old

- Introduce the value of money and saving with an allowance. While there are a few ways to institute an allowance (whether that’s tying the value to grades, above-and-beyond chores, or neither of those things), a general rule of thumb is that the allowance should have “waiting” built in. Supplying children with an amount of money that affords them instant gratification is counterintuitive to one of the biggest learning opportunities in delayed gratification and watching money grow, be that in a clear jar on the counter or in a savings account.

- From age six and up, taking children on philanthropy “field trips” to tour any organizations your family is involved in can encourage interest and inspire future support for intentional giving.

- Read the book Betty Bunny Wants Everything from Michael B. Kaplan.

- Apps like Savings Spree, Unleash the Loot!, and Bankaroo help to introduce important financial concepts.

- The Council for Economic Education offers an expansive and fun curriculum appropriate for K-12 students.

- Kiddynomics, by the Federal Reserve Bank of St. Louis, also offers a set of lessons designed to introduce young children to the economic way of thinking.

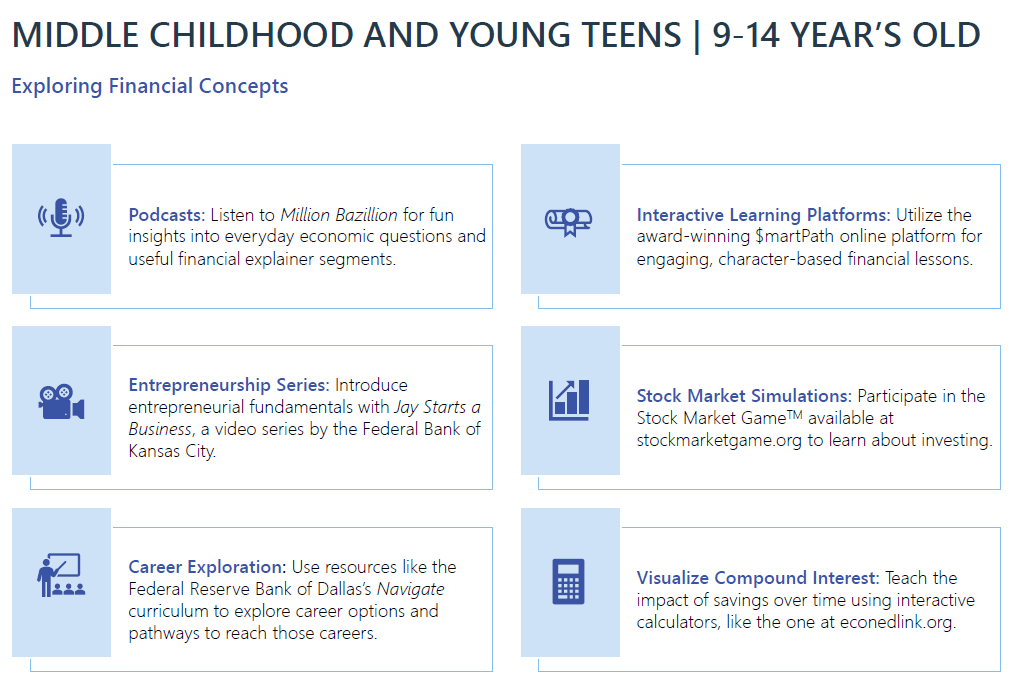

Middle Childhood and Young Teens | 9-14 Year’s Old

- Podcast Million Bazillion both answers fun questions that bring context to the value of money (Why is our money green? What’s up with those claw machines?) and offers useful explainer segments (What do grownups do with all their money? Who sets the price of rent?).

- $martPath, by the University of Cincinnati, offers fun and free online interactive learning resources for elementary and middle school students.

- The Federal Bank of Kansas City created Jay Starts a Business, an interactive adventure that introduces upper elementary students to entrepreneurship.

- SIMFA is an independent educational organization dedicated to fostering knowledge of the financial markets. They’ve developed The Stock Market GameTM, that’s suitable for children at this age.

- Navigate, developed by the Federal Reserve Bank of Dallas, allows students to explore various careers and the pathways to get there.

- Visualizing the growth of money is a powerful way for children to learn about investing. There are a multitude of compound calculators available on the web that allow children to manipulate principal, rate, and time variables and watch the effects in graphic form.

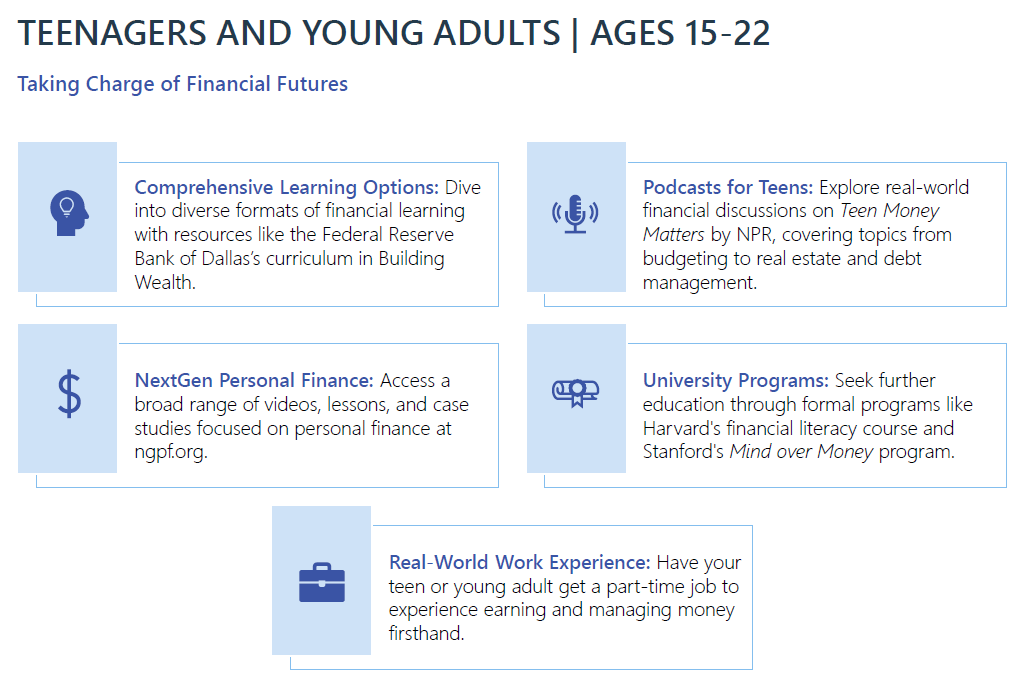

Teenagers and Young Adults | 15-22 Year’s Old

- In NPR’s podcast, Teen Money Matters, hosts interview fellow teens and local experts in the financial world and explore ways to save, budget, and understand the importance and responsibility of managing money for the future. A few interesting episodes cover topics like every-day financial negotiations, all things real estate, and managing interest and debt.

- Take a deeper dive financial education, like the Federal Reserve Bank of Dallas’s curriculum in Building Wealth: A Beginner’s Guide to Securing Your Financial Future, is available in a variety of media options to match your teen’s learning style.

- NextGen Personal Finance aims to offer everything you need to teach personal financial skills with confidence, encompassing a library of videos, case studies, lessons, and activities.

- Empowering children to continue their own development is vital. Offer general direction as to where they might start, for instance, formal programs that are available to them through school or universities, financial aid or student affairs offices, and extracurricular organizations. One great example is the Harvard financial literacy program.

- There’s no substitute for having a real job. The responsibility of showing up, taking direction, putting in the work, being a part of a team, and getting paid for those efforts and managing the subsequent income offers foundational experience you can’t get elsewhere. If you deem so appropriate, a part-time or summer-house job may be suitable for your teen or young adult.

While we recommend introducing financial concepts to younger children in this article, it’s never too late to start. No matter how old your children are—even in their twenties, thirties, or beyond—they still have the rest of their lives far ahead of them. Education is never wasted, at any age. Using the resources you have to support wealth education for the rising generation can bring lasting benefits over the course of a lifetime. If you’re interested in raising stewards of personal and family wealth, we’d be happy to connect and discuss how we can support you.

Information from third-party sources contained herein are from sources believed reliable, but have not been independently verified by Geller. Geller makes no representation as to the accuracy of information obtained from these sources. Statements that are nonfactual in nature, including opinions, projections and estimates, assume certain economic conditions and industry developments and constitute only current opinions that are subject to change without notice.